800-373-0708

Best rates in California

Auto Insurance

Start saving today!

Or Talk to a live agent

re

5000+ Satisfied customers in California

WHY DIRECT 2U INSURANCE?

5000+ satisfied customers in California. 4.9 rating in google with over 350 reviews.

We have more options when it comes to your coverage. We will tailor an insurance policy that fits your needs and your budget.

We represent 20+ different insurance companies which means you have more options when it comes to your coverage. We do the shopping. You do the saving.

Insurance professionals with expertise. A trusted advisor who have a track record of providing customers with the best deals on coverage they need.

Frequently Asked Questions about Auto Insurance

Question 1: What’s liability insurance?

Liability covers injuries or damage you cause to others in an accident. It’s the basic coverage required by California law.

Question 2: What’s the minimum insurance I need in California?

As of 2025, California requires at least 30/60/15 coverage:

$30,000 for one person’s injuries

$60,000 total for multiple people’s injuries

$15,000 for property damage

These are the new state minimums—but many drivers choose higher limits for extra peace of mind.

Question 3: What’s uninsured motorist coverage?

Roughly 1 in 6 California drivers don’t carry insurance. UM coverage protects you if one of them hits you—it can help with medical bills, lost wages, and more.

Question 4: What’s collision coverage?

Collision pays to fix your car after an accident, no matter who’s at fault.

Question 5: What’s comprehensive coverage?

Comprehensive covers damage from things other than crashes—like theft, fire, vandalism, or even hitting an animal.

Question 6: Are there extras I can add?

Yes! Popular add-ons include:

Roadside assistance

Rental car coverage

Medical payments (MedPay)

Gap insurance for financed or leased cars.

Question 7: What’s the difference between an SR-22 and a non-owner policy?

SR-22: A certificate the state requires to prove you have insurance after certain violations.

Non-Owner Policy: Covers you when driving cars you don’t own—often paired with an SR-22 if you don’t own a vehicle..

Question 8: What’s a deductible?

It’s what you pay out of pocket before insurance helps. Example: with a $500 deductible on a $2,000 repair, you pay $500 and insurance pays $1,500.

Question 9: What’s a premium?

Your premium is your insurance bill—the amount you pay monthly, quarterly, or yearly to stay protected.

Question 10: What factors determine my rate?

Your rate depends on several things, including:

Your driving record (tickets, accidents, or DUIs)

Your age and driving experience

Where you live and park your car

The type of car you drive (repair costs, safety ratings, theft risk)

How much you drive each year

The coverages and deductibles you choose

Discounts you may qualify for (safe driver, multi-car, bundling, etc.).

Our Office:

Email: [email protected]

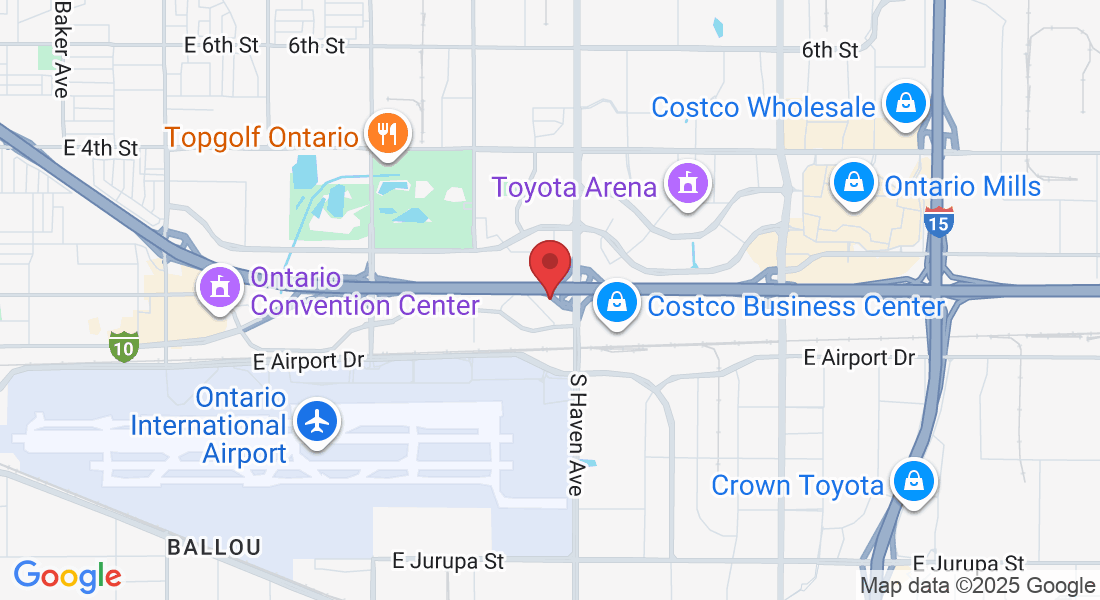

Address:

3401 N Centre Lake Dr, Suite 520 Ontario, CA 91761

Hours:

Mon – Fri 9:00am – 6:00pm

Sat 10:00am - 2:00pm

Sunday – CLOSED

Phone Number:

800-373-0708

Office: 3401 N Centre Lake Dr Suite 520 Ontario, CA 91761

CA License # 0M59846

Call 800-373-0708

Email:[email protected]

YouCopyrights 2025 | Direct 2U Insurance Services Inc™ | Terms & Conditions | Privacy Policy